For anyone who ever loved to track down baseball cards, comic books, or other collectibles, there was nothing like looking up the value of your most prized possession. For kids, it was often a harsh discovery that the outfielder you spent several dollars on was worth just a fraction of the selling price. Finding out that perceived value and actual value aren’t the same is a lesson that adults deal with too, but on a larger scale: home sales.

Home for sale, courtesy of Mark Moz, CC BY 2.0.

There has always been a difference between what sellers believe a house is worth and the value estimated by an appraiser, as we have written about before. In the last decade, the average spread has been as much as 8% when home prices dropped at the start of the Great Recession.

According to Quicken Loans’ Home Price Perception Index (HPPI), the average difference nationally was just 2% at the start of 2006, with appraisers seeing values lower than sellers do. A year later, appraisers and sellers agreed on values for 2 months in 2007, before appraisers once again perceived values as lower than those selling their houses did. When the economic downturn was in full effect, sellers watched as their homes lost value at a rate much higher than they expected. At the tail end of 2008, sellers viewed home values as more than 8% above how appraisers valued homes.

Then the housing market began its slow recovery, and in 2013 appraisers were valuing homes higher than home sellers. Appraisers kicked off 2014 by estimating homes more than 2% above the sellers’ estimates. Since that time, the pendulum has swung back in the opposite direction. So far in 2016, sellers on average are overestimating the value of their homes by a little less than 2%.

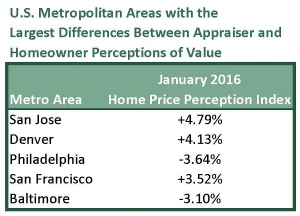

Differences of opinion between sellers and appraisers are more likely to occur in rapidly changing markets. In a hot market, prices may actually rise more quickly than sellers expect, whereas it is the appraiser’s job to be aware of such unsustainable market changes. Conversely, if the local housing market is doing poorly, sellers may not realize that area homes are being appraised relatively lower than their perceptions.

HPPI data from Quicken Loans.

Homes in San Jose, Denver, and San Francisco had appraisers valuing homes above the sellers’ perceived prices by the widest margin. That’s not too much of a surprise since these are known to be very hot markets. San Francisco was recently named North America’s most expensive housing market, and San Jose was the third most expensive market. San Francisco was one of only two cities with median home prices above the million-dollar mark in December 2015. Denver was the 13th most expensive housing market in North America, with median home prices of $350,000.

Overall, home price estimates by sellers and appraisers have followed a similar path over the years. When appraisers value homes lower than expected, homeowners’ estimates tend to trend down as well, and vice versa. Some might call this process “convergence” or “mean reversion.” With the housing market roaring ahead, there are more buyers than sellers, a fact that should continue to push home prices up in the coming months.

Recent Comments