There’s a different feeling in the air this summer for those in the housing market. The sun might feel a little brighter, the birds chirping a little louder.

It was just a few years ago that homes would sit for sale, even in the busy summer season, for months or even years. This year the market saw a strong April that could lead to a good summer for sellers. Pending home sales hit a 9-year high in April, marking 2015 with four straight months of rising home sales. The Pending Home Sales Index was 112.4 in April, 14% higher than in April 2014 and at its highest level since May 2006. The Pending Home Sales Index is based on pending sales of existing homes in a national sample of sales transactions. An index of 100 is equal to the average level of contract activity during 2001, which had a sales volume of existing homes considered normal for the current U.S. population.

The price of new homes followed closely, rising 2.7% in April over March prices. The increase helped push a 6.8% jump from a year ago. Prices are often connected to inventory, and with sales volume on the way up, prices typically follow as quantity supplied falls behind quantity demanded. Mortgage rates, which remain at historic lows, are giving potential buyers even more reason to enter the market this spring and summer.

However, the news isn’t all positive. While the housing market does seem to be improving, the lack of supply is putting a crimp on some looking to buy.

“For the average American across the country … it’s really tough to buy a home. Homes are in short supply and we haven’t seen production come back,” said Lennar CEO Stuart Miller.

Recent data shows that homebuilder sentiment is down in May from the previous month. Mortgage applications also dipped in May by nearly 8%. April saw housing starts jump to a 7-year high, a sign the market realizes that demand is increasing. The supply of existing homes was up in April as well, but below 2014 numbers. While total housing inventory had increased 10% to 2.21 million existing homes for sale at the end of April, that’s still 0.9% below the 2.23 million homes available a year ago.

The limited supply contributes to the rising prices of homes for sale. Prices are rising faster than personal income, which is one reason first-time buyers are not as excited about searching for a new home.

“The Millennials have not jumped into the market as first-time buyers,” Miller noted. “Historically, it’s always been an axiom of our business that when 20-year-olds move back home, it takes 6 to 12 months for everyone to realize it’s a bad idea. This time around, that’s not the case.”

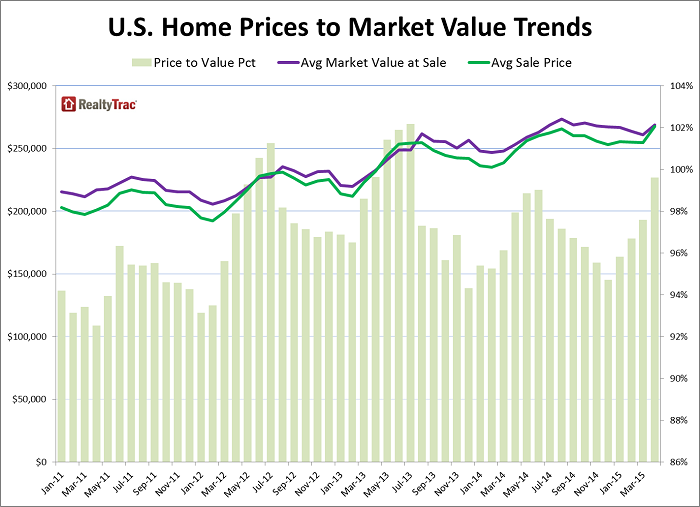

The delicate balance of supply and demand is playing out in markets across the country. In 27% of the markets of populations of at least 100,000 with at least 100 sales in April, sellers saw their homes sell for more than the estimated market value of the homes. However, buyers came out on top in 59% of the markets as homes in those markets changed hands for less than the estimated market value.

Chart comparing trends in U.S. home prices and market value from RealtyTrac.

How do you see the housing market adapting and changing over the summer? Let us know in the comments.

Recent Comments