Odds are you know someone who has been taken advantage of by an unscrupulous lender. While there is no official definition of predatory lending, it is generally considered to include any lending practice in which the lender imposes abusive loan terms on a borrower or uses deceptive or coercive means to convince a borrower to accept a loan that the borrower doesn’t need, doesn’t want, or can’t afford.

Predatory lending exists in many different contexts, such as mortgage loans, home equity lines of credit (HELOCs), credit cards, car-title loans, overdraft loans, payday loans, and tax refund anticipation loans. Those most likely to be targeted include the elderly, the poor, minorities, military service members, and the less educated, but anyone who doesn’t have a good understanding of finance or is in need of immediate cash could fall victim.

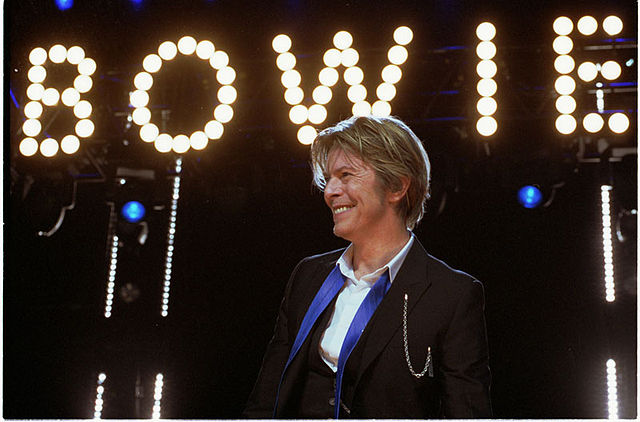

Atlanta Title Loans, a car-title loan provider, courtesy of Ken Teegardin, CC BY-SA 2.0.

Debt Traps

Receiving a predatory loan can trap a borrower in a cycle of debt, reducing their ability to pay other bills in a timely fashion, lowering their credit score, increasing their future costs, and decreasing their access to jobs and housing, thereby decreasing their wealth-building opportunities for many years to come. Borrowers with car-title loans from TitleMax, one of the largest car-title lending companies, took an average of nine high-cost loans per year with a typical term of 30 days, paying back over three times the amount borrowed on average.

Similarly, in an analysis of bank payday lending data from 2010 and 2011, researchers from the Center for Responsible Lending (CRL) found that the mean number of loans each borrower with bank payday loans took in a year was 19, and 12% of these borrowers took out 36 or more loans in a year. And because of the high costs and very short loan terms, the typical annual percentage rate (APR) for these loans ranged from 225% to 300%. Loans with abusive terms also have higher default rates, possibly leading to car repossession or home foreclosure, and increase the likelihood of the borrower declaring bankruptcy.

But predatory lending doesn’t just harm the borrower, it harms the entire economy. A study conducted by the Insight Center for Community Economic Development found that the payday lending industry caused a net loss of nearly $1 billion and over 14,000 jobs from the U.S. economy in 2011.

First, Do No Harm

Many predatory lending practices have caught the attention of the media, consumer advocates, and public officials, but as with many other complex challenges, no one is sure about how many people have been affected or how much harm has been done. The lack of a single definition of predatory lending makes it difficult to document the full extent of the problem and decide how best to manage it.

So why have regulatory agencies and other interested parties been unable to reach a consensus on what constitutes predatory lending practices that should be illegal? Some lending practices, such as charging unreasonably high fees or interest rates, including hidden costs, flipping loans (repeatedly making new loans to refinance existing loans), or intentionally providing inaccurate or incomplete information, are clearly predatory. However, while high interest rates and/or fees are common characteristics of predatory loans, high-cost loans are not necessarily predatory.

Payday loans sign, courtesy of stallio, CC BY-SA 2.0.

According to the Federal Deposit Insurance Corporation (FDIC), more than 33 million households lack sufficient access to traditional banking services, and instead rely on alternative financial services. A 2009 study by George Washington University found that 54.7% of payday loan borrowers were “very satisfied” with the service, an additional 33.7% were “somewhat satisfied,” and 86% agreed that payday loan companies provide a useful service to consumers. There have been many disagreements about where exactly to draw the line between socially responsible risk-based lending and predatory lending practices. Lenders must charge more for higher-risk loans, so regulators need to exercise some caution if they want the most financially vulnerable among us to still have access to credit.

Consumer Protection Laws

Many state and federal laws have been passed to try to protect consumers from predatory lending practices. Federal laws include the Federal Trade Commission Act of 1914 (FTC Act), Consumer Credit Protection Act of 1968 (CCPA), Truth In Lending Act of 1968 (TILA), Fair Credit Reporting Act (FCRA) of 1970, Equal Credit Opportunity Act of 1974 (ECOA), Real Estate Settlement Procedures Act of 1974 (RESPA), Home Ownership and Equity Protection Act of 1994 (HOEPA), Military Lending Act of 2006 (MLA), and Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act).

The Consumer Financial Protection Bureau (CFPB) was created in July 2010 as part of the Dodd-Frank Act, and as part of its mission to ensure fair practices in consumer financial markets, it has enacted recent amendments to many of the acts listed above. The bureau has also filed civil enforcement actions against financial institutions, law firms, and others who have engaged in predatory lending practices. And in May of this year, CFPB launched its Financial Coaching Initiative, placing 60 certified financial coaches at organizations around the country to provide educational services to transitioning veterans and economically vulnerable consumers.

On July 22, 2015, in consultation with the CFPB, the U.S. Department of Defense (DoD) dramatically expanded the scope of the MLA to provide active-duty military service members and their dependents additional protection from predatory lending practices. The new rule extends previous prohibitions on lenders charging more than 36% interest, assessing prepayment penalties, or requiring dispute arbitration to a wider array of financial products. It also severely limits the sale of add-on products such as credit insurance, debt cancellation contracts, or debt suspension agreements.

Consumer Education and Source of Assistance

Crossroads: Bankruptcy or Counseling, courtesy of StockMonkeys.com, CC BY 2.0.

While there’s still a lot of disagreement about the best regulatory means to reduce predatory lending, experts agree that the best way to prevent it is through better consumer education. In addition to the CFPB financial coaches mentioned above, some of the many resources available to consumers include credit counselors, debt counseling agencies, and nonprofit organizations such as the AARP. The HUD Office of Housing Counseling Predatory Lending offers tips and resources specifically for those seeking a mortgage. Many states also provide resources to help consumers avoid predatory lending, such as this page from the California Department of Real Estate; state and local consumer protection agencies are another potential source of information and assistance.

What do you think should be done to prevent predatory lending while preserving access to credit? Let us know in the comments, because we’re always interested to hear from you.

Recent Comments